Indicators on Lamina Loans You Should Know

The Best Guide To Lamina Loans

Table of ContentsThings about Lamina LoansSee This Report about Lamina LoansLamina Loans - TruthsThe Lamina Loans StatementsLamina Loans - An Overview

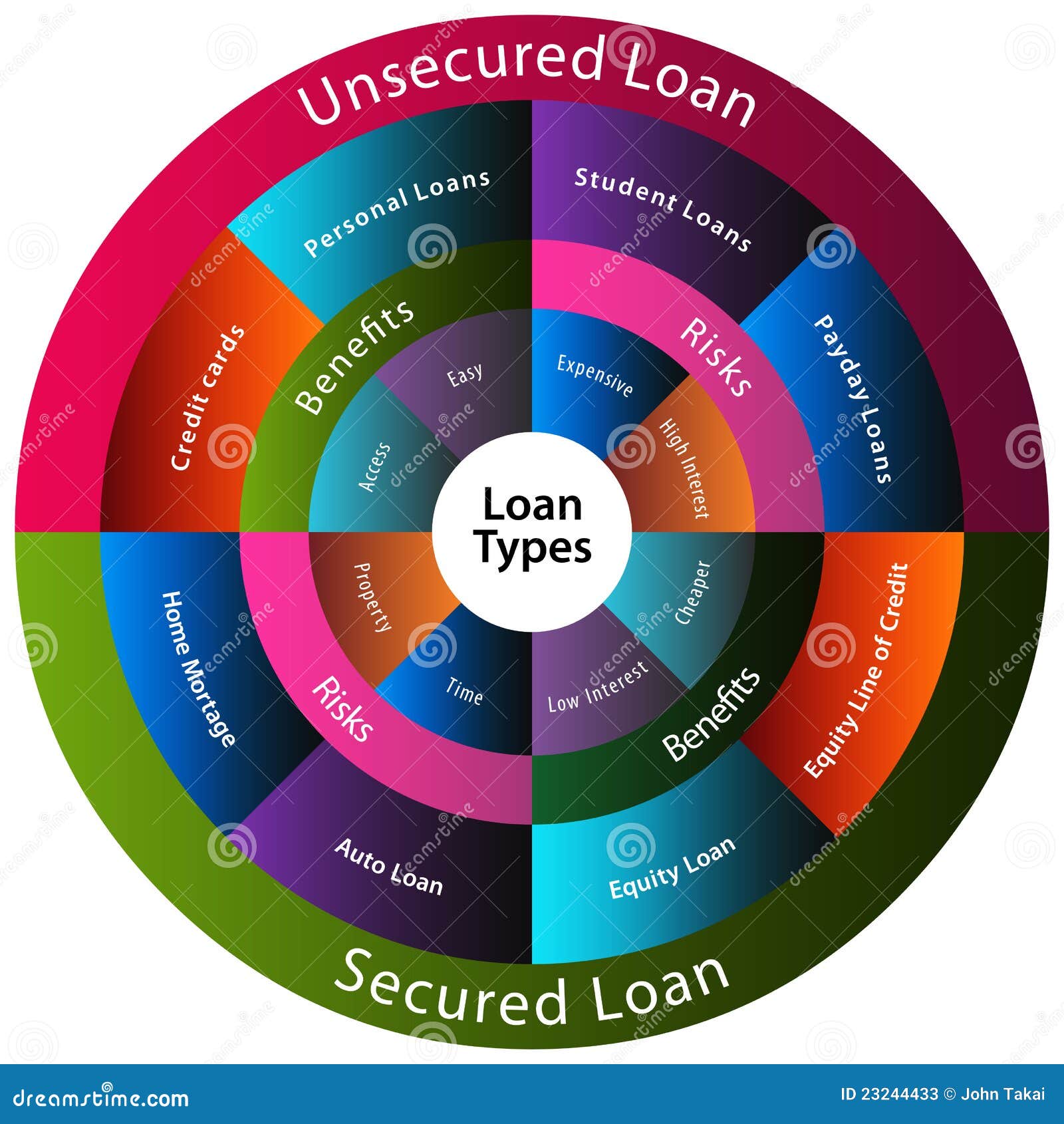

Different types of fundings can provide access to possessions, career growth and also various other opportunities. Overall, there are 9 kinds of loans you ought to understand, and also they cover various kinds of good as well as uncollectable loan. Whether you're searching for funds to attend college or acquire your first residence, here's what you need to know about each kind of car loan.Functions of each funding kind like car loan length and passion prices can vary. (APRs) and also taken care of minimum regular monthly payments.

, you won't need security to apply for one simply an excellent credit score and also regular as well as strong credit report history. Personal loans can normally be made use of for just regarding any kind of purpose.

Lamina Loans Can Be Fun For Anyone

:max_bytes(150000):strip_icc()/Term-Definitions_loan.asp-b51fa1e26728403dbe6bddb3ff14ea71.jpg)

A financial debt combination financing may not be best for those with poor credit, as it may not deserve it to seek it if you can not acquire a lower APR. To learn if this kind of debt is an excellent suitable for you, determine your potential savings making use of a financial debt loan consolidation calculator.

Many home mortgages loans are 15, 20 or 30 years long, though you might also discover longer or shorter terms. They can come with taken care of or variable interest rates.

These types of loans are commonly unsafe as well as can cover expenses ranging from bed and board, publications as well as tuition. They can come with dealt with or variable rate of interest prices. This kind of financial debt can be split into two groups: personal as well as federal pupil financings. As the names suggest, the former are stemmed by private business, while the latter is funded by the federal government.

Bank loan are a kind of credit score that enable entrepreneurs to gain access to capital to expand their expanding companies. This can suggest using finance funds for tools, purchasing inventory or perhaps covering pay-roll. Some lending institutions even offer SBA finances backed by the Small Business Administration (SBA); these can be as large as $5 million.

What Does Lamina Loans Mean?

Instead of getting a swelling amount of cash or a possession upfront, the lending amount is saved in a secured checking account that you can only gain access to when you settle the loan. By doing this, your lending functions as collateral. Building credit rating from the ground up can take some time, but the pledge of getting your funding funds after it's settled may work as a great motivator for some borrowers.

With amounts commonly as much as $500, cash advance fundings are considered a predative type of financing due their overpriced passion prices (as high as 400%) (Lamina Loans). Combined with brief payment terms of simply 2 to four weeks, payday lendings can quickly catch customers in a cycle of financial debt, as they might have to take more lendings to settle their original payday financial debt.

Your credit rating one of the most typical of which are FICO Rating and also Vantage, Score will establish the tone wherefore lending institutions you may certify with and what APRs you might get. If you choose to secure a funding that supplies a versatile car loan purpose, you'll still require to reveal to your lender just how you prepare to use the funds as some loan providers have limitations on just how lendings can be additional reading used.

This is how much it will cost you to take out a funding, including passion prices and also costs. A excellent credit scores score as well as a solid credit history profile can assist you gain access to lower APRs which, subsequently, permits you to spend less cash on the loan. Just how much time you need to settle your lending has an influence on investigate this site what APRs you're paying.

Indicators on Lamina Loans You Need To Know

On the other side, the shorter your settlement term is, the reduced your APRs, however the greater your regular monthly settlements are. Exactly how much you're permitted to borrow will depend upon variables like your income, exactly how you intend to use the finance and your credit report. Maintain in mind, if you have negative credit report, you might have a difficult time getting a big finance amount.

Borrowed money can browse around here be made use of for several functions, from moneying a new organization to purchasing your future husband an engagement ring. With all of the different kinds of car loans out there, which is the bestand for which purpose? Below are one of the most typical types of lendings and also how they function.

Home-equity car loans have reduced interest rates, but the consumer's house functions as collateral. Cash loan generally have extremely high interest rates plus transaction costs. Most financial institutions, physical and also on-line alike, use individual lendings, and the proceeds might be made use of for basically anything from acquiring a brand-new clever TV to paying bills.

Little Known Facts About Lamina Loans.

Debtors require some type of income confirmation as well as evidence of possessions worth at the very least as much as the amount being obtained. The application is usually just a page or two in size, and the approval or denial is typically issued within a few days (Lamina Loans).

21% in the very first quarter of 2023, according to the Federal Reserve. Rate of interest prices can be more than three times that amount: Avant's APRs vary from 9. 95% to 35.

An individual lending is possibly the very best method to go for those who need to borrow a fairly small quantity of cash as well as are particular they can settle it within a couple of years. A personal funding calculator can be an useful tool for determining what sort of interest price is within your means. A financial institution might release an assurance as surety to a third event on part of one of its clients. If the client falls short to accomplish the relevant contractual obligation with the 3rd party, that event can require payment from the financial institution. The assurance is commonly a plan for a financial institution's small-business customers.